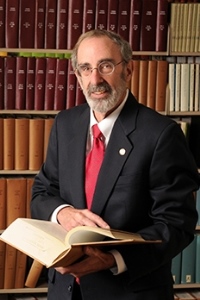

Malcolm L. Morris

Member, Board of Directors; Dean and Professor Emeritus

mmorris@johnmarshall.eduEducation

B.S., Cornell University

J.D., SUNY at Buffalo

LL.M., Northwestern University

Career Highlights

Malcolm L. Morris served as Dean and Professor of Law at Atlanta’s John Marshall Law School from July 2014 to January 2020. Dean Morris was named Dean and Professor Emeritus at the January 2020 Board of Director’s meeting and was appointed to the Law School Board of Directors in July 2023.

On February 5, 2020, Dean Morris was named an Outstanding Georgia Citizen by the Secretary of State, Brad Raffensperger.

Also on February 5, the Georgia Senate recognized and commended Dean Morris in Senate Resolution 730, sponsored by Senators Jackson of the 2nd and Jones of the 10th, for his outstanding service as Dean to Atlanta’s John Marshall Law School and for his efficient, effective, unselfish, and dedicated public service to the State of Georgia.

The road to Dean at Atlanta’s John Marshall Law School was paved with impressive leadership positions, research, and service to legal education and the legal community. As one of the most prominent legal scholars in notary law, Dean Morris was the inaugural recipient of the Lifetime Achievement Award from the National Notary Association. Dean Morris was the Director of Graduate Estate Planning Programs and the Associate Director of Graduate Tax Law Programs. He also served two terms as the Associate Dean and one term as the Interim Dean at Northern Illinois University College of Law. During his tenure there, he was a member of the University Council, elected Secretary of the Faculty Senate and was a member of the Strategic Planning Committee, as well as the University Personnel Advisor. Additionally, he has been active as an ABA accreditation site visitor, Board Member and Treasurer of CLEO, Inc., LSAC trustee, and member of various AALS and ABA committees. During his time in Illinois, Dean Morris chaired and participated on numerous Illinois State Bar Association committees, received a number of awards for those efforts, including the prestigious Austin Fleming Award, all of which led to his induction as a Laureate in its Academy of Illinois Lawyers. He also has an extensive scholarship record that includes works published in both law reviews and practitioner-oriented publications.

Publications

Academic Articles

Education Expense Epiphanies, 47 Buff. L.Rev. 875 (1999).

Nomadic Notaries, 32 J. Marshall L. Rev. (Notarial Law and Policy Symposium II) 985 (1999).

Troubled Taxpayers’ Tolling Troubles, 47 Syracuse L. Rev. 121 (1996).

(Republished: Digest of Tax Articles, February, 1998).

Suffering Soliman’s Solution, 55 U. of Pitt. L. Rev. 99 (1993).

Determining Deductions Deserves Deductibility, 21 Fla. St. U. L. Rev. 75 (1993).

Troubling Transfer Tax Tie-Ins, 1991 Utah L. Rev. 749.

An ‘Imputed Interest’ Corollary to the ‘Constructive Transfer’ Doctrine: Pay the Tax or Follow the Leder?, 54 Mo. L. Rev. 599 (1989).

Taxing Economic Loss Recovered in Personal Injury Actions: Towards A Capital Idea?, 38 U. Fla. L. Rev. 735 (1986).

Reliance on Counsel as Reasonable Cause: To the Back Burner After Boyle?, 31 Vill. L. Rev. 525 (1986) (Published as Article Summary, Callaghan’s Law Review Digest, Vol. 36 No. 4 (1987)).

The Tax Posture of Gifts in Estate Planning: Dinosaur or Dynasty?, 64 Neb. L. Rev. 25 (1984).

Disclaiming Joint Interests: One New Trick and No Longer a Dog?, 1983 Ariz. St. L.J. 45. (Republished: Digest of Tax Articles, December, 1984).

Rediscovering the Resulting Trust: Modern Maneuvers for a Dated Doctrine?, 17 Akron L. Rev. 43 (1983).

Books, Chapters, and Commentaries

Commentary, Model Notary Act of 2010.

Commentary, Model Notary Act of 2002.

Commentary, Notary Public Code of Professional Responsibility (1998).

Notary Law and Practice: Cases and Materials, NNA Publishing (1997) (with Closen, Ahlers, Jarvis and Spike).

Professional Writings

“Sorry, My Mistake: Correcting Putative Testamentary Errors,” Trusts & Estates Vol. 58, No.3 (Sept. 2011).

“Chasing Custodial Claims,” Trusts & Estates Vol. 48, No.1 (November 2001).

“Here’s Your Inheritance, But Pay the Tax Before You Leave,” Trusts and Estates, 47-2 (December, 2000).

“Non-‘Trust’worthy Expenses,” Trusts and Estates, 47-1 (August, 2000).

“Taxing Family Matters,” The Counselor, 00-2 (June, 2000).

“Taking Business Interest Personally,” The Counselor, 99-4 (November, 1999).

“Liability for Ordering Improper Notarial Acts,” The Counselor, 99-3 (August, 1999).

“And the (Tax) Cases Just Keep Coming,” The Counselor, 98-3 (June, 1998).

“Explaining Family Limited Partnerships to Clients,” The Counselor, 98-2 (March, 1998).

“New Attacks on Time-Honored Tax Savings Techniques,” The Counselor, 98-2

(March, 1998).

“Education Tax Incentives,” The Counselor, 97-4 (December, 1997).

“Taxpayer Relief Act of 1997: Overview and Observations,” The Counselor, 97-3 (September, 1997).

“The President’s Tax Proposals,” The Counselor, 97-2 (June, 1997).

“Using Common Law Theories to Collect Tax,” The Counselor, 96-3 (September, 1996).

“Limits on Asset Protection Against the Government,” The Counselor, 96-2 (June, 1996).

“Deducting Deficiency Interest,” The Counselor, 96-1 (March, 1996).

“New Executor Fee Concerns,” The Counselor, 95-3 (September 1995).

“Deferred Compensation Developments,” The Counselor, 95-2 (June 1995).

“Stumbling Over ‘Stub’ Income,” The Counselor, 95-1 (March 1995).

“Disclaimers and Public Aid Assistance,” The Counselor, 94-4 (December, 1994).

“Taxing Receipt of a Partnership Profits Interest,” Federal Taxation, Vol. 40, No. 4

(January, 1994).

“Disclaimers in Bankruptcy,” The Counselor, 93-5 (December, 1993).

“Casualty Loss Claims,” Federal Taxation, Vol. 40, No. 3 (December 1993).

“Preliminary Thoughts on the 1993 Revenue Reconciliation Tax Act,” The Counselor, 93-3 (September, 1993).

“Perfecting Points,” The Counselor, 93-1 (March 1993).

“Taxing Interest Recalculation Errors,” The Counselor, 92-4 (December, 1992).

“News From the Home-Office Front,” Illinois Bar Journal, Vol. 80, p. 244, (May, 1992).

“Refinancing Ruminations,” The Counselor, 92-1 (March, 1992).

“Deducting Estate Planning Fees,” Estate Planning Probate and Trust, Vol. 38, No. 2

(October, 1991).

“New Transfer Tax Concerns for Business Valuations,” The Counselor, 90-4

(November, 1990).

“Must Reimbursed Expenses Be Subject To Two Percent Rule of I.R.C. §67?” The Counselor, 89-1 (January, 1989).